Financial Wellness Advice: A Comprehensive Guide to Prosperity

Financial wellness is no longer just a trendy term; it’s a fundamental aspect of living a healthy, balanced life. Understanding how to manage your finances effectively can lead to not only monetary benefits but also profound improvements in your emotional and psychological well-being. In this deep dive, we will explore various dimensions of financial wellness advice, breaking down the key components necessary to achieve a state of financial health that supports your dreams and aspirations.

What is Financial Wellness?

At its core, financial wellness reflects your understanding of your financial situation and how it impacts your overall well-being. It encompasses more than just savings or investments; it’s about having a comprehensive view of your financial health. This includes:

- The ability to manage daily expenses

- Planning for future financial needs

- Establishing and maintaining savings

- Effectively managing debt

- Preparing for unforeseen financial emergencies

Importance of Financial Wellness

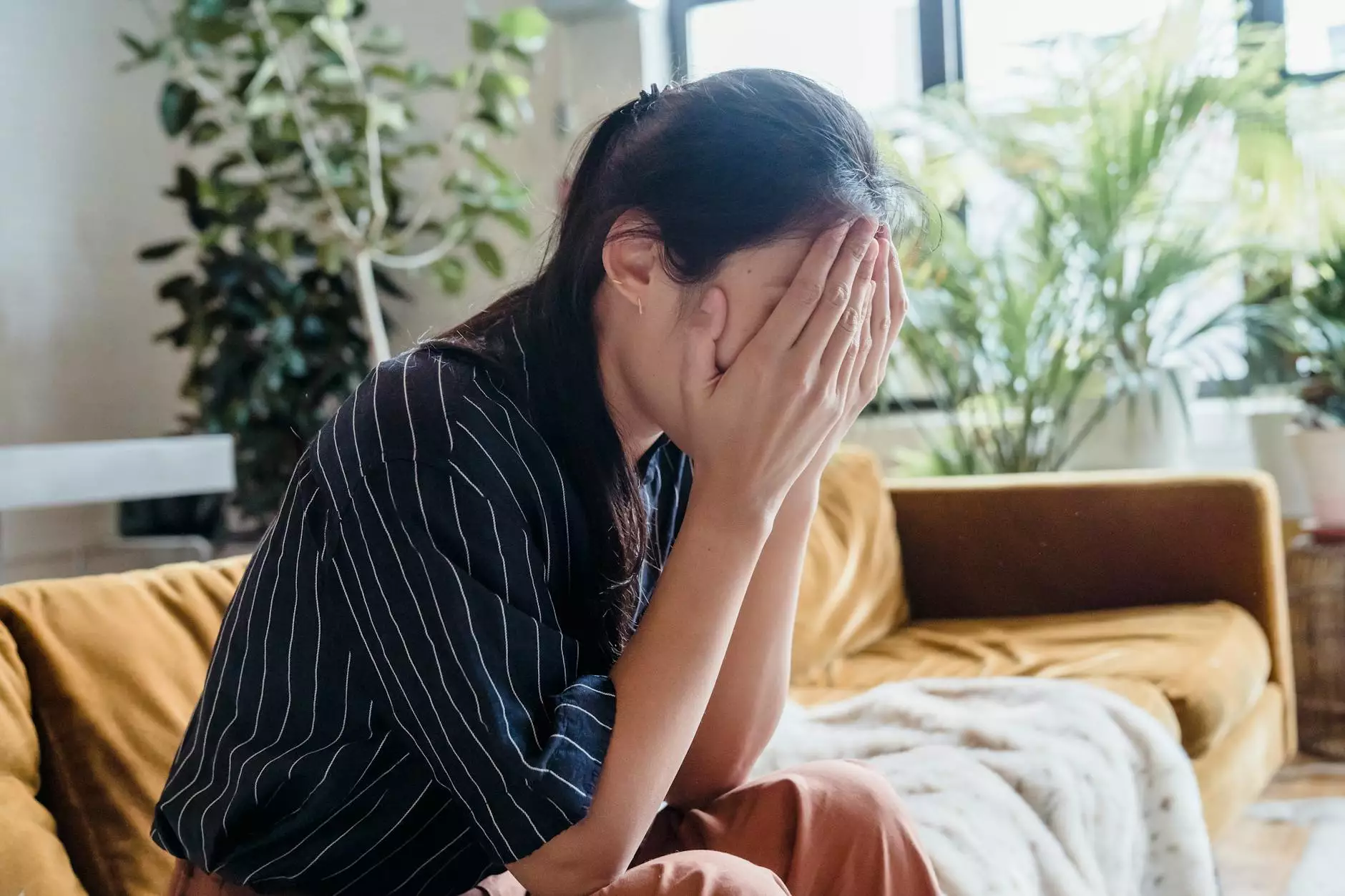

Why should you prioritize financial wellness? The answer is simple: financial stress can have adverse effects on both physical and mental health. Here’s how:

- Reduced Stress Levels: Financial uncertainty contributes significantly to stress. By achieving financial wellness, you reduce anxiety, leading to improved mental health.

- Improved Relationships: Money is often a topic of contention in relationships. Clear financial communication fosters trust and enhances bonding.

- Better Decision Making: Financial literacy and planning empower you to make informed decisions aligned with your goals.

- Enhanced Opportunities: A firm grasp on your finances opens doors to opportunities that can lead to personal and professional growth.

Key Components of Financial Wellness

To embark on your journey towards financial wellness, it’s essential to focus on several core components:

1. Budgeting and Expense Tracking

A solid budget is the backbone of financial management. It lays the groundwork for understanding where your money goes and how you can better control it. Here are effective strategies for budgeting:

- The 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Use Budgeting Tools: Leverage apps like Mint, YNAB (You Need A Budget), or even simple spreadsheets to track your expenses.

- Review Regularly: Make it a habit to review and adjust your budget every month to reflect changes in your financial situation.

2. Saving Strategically

Saving money should be a priority, but not all savings strategies are created equal. Here are some vital tips:

- Emergency Fund: Aim to save at least 3-6 months’ worth of expenses for unexpected events.

- Automate Savings: Set up automatic transfers to your savings account each payday to build your savings without the temptation to spend.

- Set Specific Goals: Whether it’s saving for a vacation, a home, or retirement, specific goals make it easier to stay motivated.

3. Debt Management

Debt is a reality for many, but the way you manage it can significantly impact your financial wellness. Here are strategies for effective debt management:

- Assess Your Debt: List all debts, including amounts and interest rates, to understand your overall picture.

- Debt Snowball vs. Avalanche: Choose a repayment strategy that works best for you—smallest balances first (snowball) or highest interest rates first (avalanche).

- Consider Professional Help: If your debt feels overwhelming, consult a financial advisor or a certified credit counselor for guidance.

4. Investing Wisely

Investing is about making your money work for you. Here’s how to get started:

- Educate Yourself: Learn the basics of investing—stocks, bonds, mutual funds, and real estate.

- Start Early: The earlier you start investing, the more time your money has to grow.

- Diversify: Don’t put all your eggs in one basket—spread your investments across different asset classes.

Financial Wellness Advice for Different Life Stages

Financial wellness strategies can vary significantly depending on your life stage. Let’s examine tailored financial wellness advice for different life phases:

Young Adults: Starting Strong

Starting your financial journey on the right foot is crucial. Here’s what young adults can do:

- Build Credit: Start with a secured credit card to establish a credit history.

- Create a Budget: Begin by understanding expenses, especially as you transition from college to the workforce.

- Invest in Education: Consider investing in further education or certifications that can boost your earning potential.

Midlife: Consolidation and Growth

As you enter your mid-career, focus on consolidating your financial strategies:

- Retirement Planning: Maximize contributions to retirement accounts such as 401(k)s or IRAs.

- Insurance Needs: Review and update insurance policies to ensure adequate coverage for life, health, and property.

- Estate Planning: Consider creating a will and planning for the future distribution of your assets.

Retirement: Enjoying Financial Independence

In your retirement years, it’s important to manage and deploy your assets wisely:

- Budget on Fixed Income: Develop a new budget that reflects your fixed retirement income.

- Healthcare Costs: Plan for potential healthcare costs that come with aging.

- Pass on Wealth: Consult a financial advisor about effective strategies for passing wealth to the next generation.

Conclusion: Your Path to Financial Wellness

Achieving financial wellness is a journey, not a destination. It requires consistent effort, a willingness to learn, and a proactive approach to managing your finances. Whether you are just starting out, are in the midst of a career, or are enjoying retirement, understanding your financial health is vital. By following the financial wellness advice outlined in this article, you can create a stable financial future that empowers you to live your best life.

For more insights and personalized financial guidance, visit greenweblife.com. Embrace your financial wellness journey today, and unlock the potential for a brighter tomorrow!